salt tax cap married filing jointly

It is 5000 for married taxpayers filing. Everything is included Premium features IRS e-file 1099s and more.

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

In the 2017 Tax Cuts and Jobs Act the federal government enacted a 10000 limit for joint and individual filers and a 5000 limit for married couples filing separately.

. Salt cap of 10000. Ad Delivering results expertise and proactive client service for International Tax Advisory. Underwood calls for increasing the federal cap to 15000 for single filers and 30000 for those who are married and filing jointly.

The SALT workaround is an option for the. My partner and I each received 1099gs in a high tax state. The proposal also addresses an unfair.

Ad E-File Your Taxes for Free. Trying to figure out how much of our 2018 state refund. New tax law for 2018.

Is this the same number for single married filing jointly and married filing singly. The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. Make the World Your Marketplace With Aprios International Tax Planning Services Today.

Hello Its my first time filing a joint return for 2019 year. 52 rows As of 2019 the maximum SALT deduction is 10000. As it stands the 10000 cap is in place.

The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. Pdf Introduction Some lawmakers are seeking to repeal the 10000 cap for single and married couples jointly filing on state and local tax SALT deductions put in place. Filing Status 2017 Standard Deduction Amount 2021 Standard Deduction Amount Single Married Filing Separately 6350 12550 Married Filing Jointly Qualifying Widow 12700.

Under tcja the salt deduction was. The arrival of the TCJA meant that the standard deduction amount was increased which reduced the number of taxpayers eligible to have deductions and capped the overall. The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately.

Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. New tax law for 2018. The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately.

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Home Ownership Matters 3 Key Changes For Homeowners Under The New Tax Law Key Change Homeowner Change

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

:max_bytes(150000):strip_icc()/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

Use Nongrantor Trusts To Bypass The Salt Deduction Limit Miller Kaplan

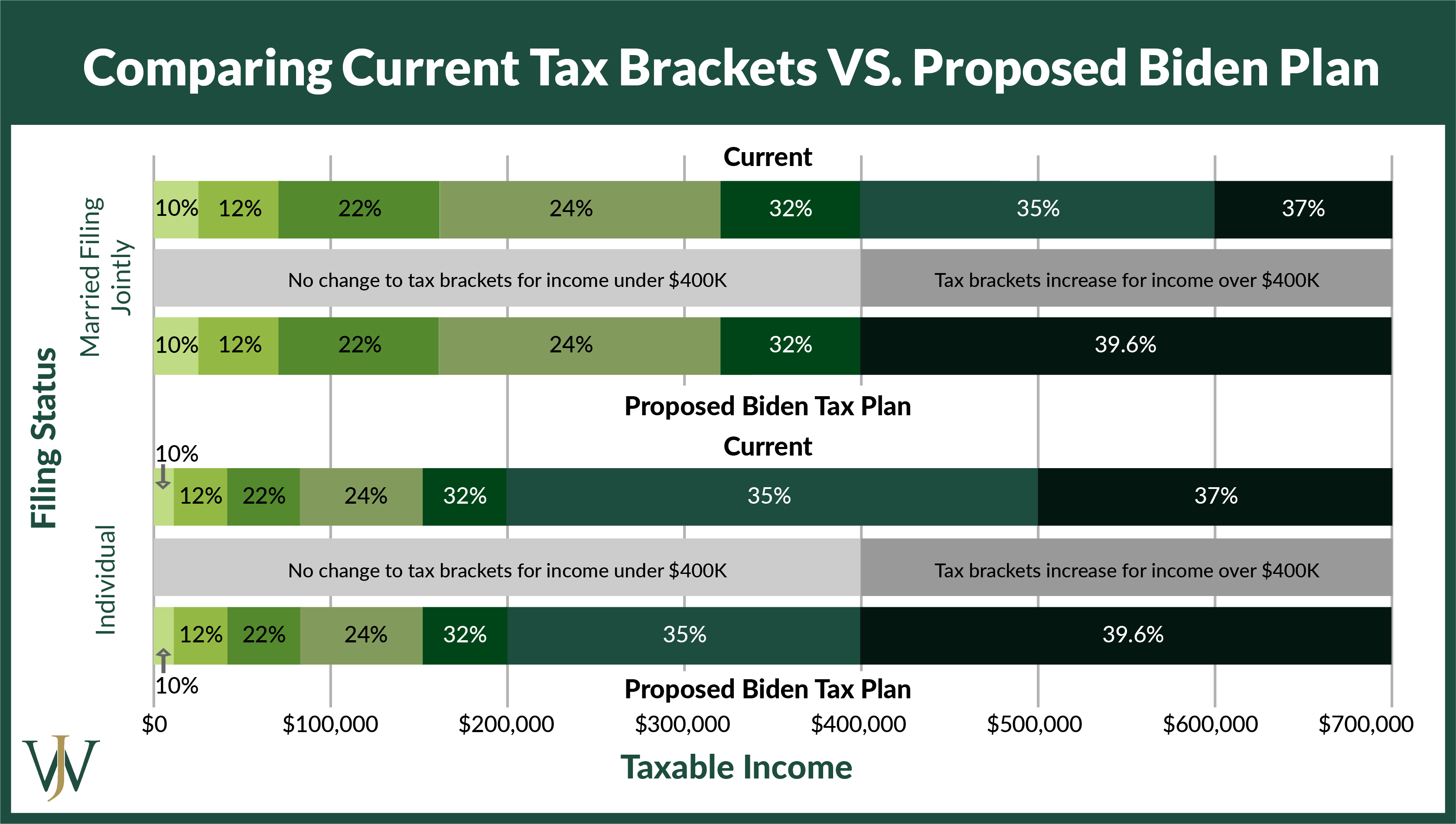

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

How Does The Deduction For State And Local Taxes Work Tax Policy Center

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

How Does The Deduction For State And Local Taxes Work Tax Policy Center

California Democrats Have Chance To Restore Salt Deductions Los Angeles Times

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

Salt Cap Repeal Is Pushed For The Few Not The Many Wsj

How Does The Deduction For State And Local Taxes Work Tax Policy Center